Prudential leads all life sellers as Q3 sales rise 3.2%, Wink reports

Prudential Financial ranked No. 1 in overall life insurance sales during the third quarter, with a market share of 5.7%, Wink, Inc. reported.

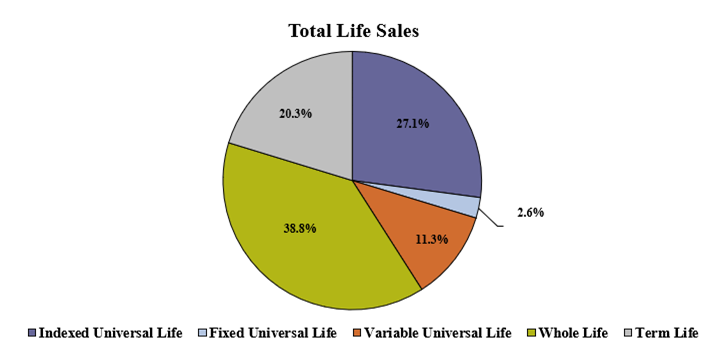

All life sales for the third quarter were more than $2.8 billion, down 3.9% compared to the previous quarter and up 3.2% compared to the same period last year, according to Wink’s Sales & Market Report. All life sales include fixed universal life, indexed UL, variable UL, indexed whole life, whole life, and term life product sales.

Prudential is a market leader in variable universal life insurance and CEO Andy Sullivan pointed to its industry dominant distribution as one reason why. Sullivan spoke last month during the insurer’s third-quarter earnings call.

Prudential also cited “disciplined pricing, expense management and optimizing in-force business” as reasons for its strong life insurance segment showing.

Transamerica Life’s Financial Foundation IUL II, an indexed universal life product, was the No. 1 selling product for all life sales, for all channels combined, for the second consecutive quarter, Wink reported.

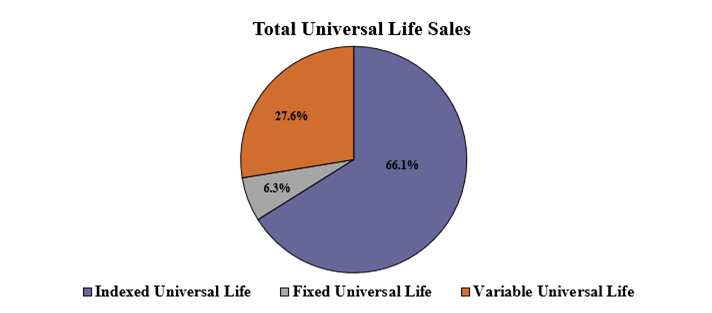

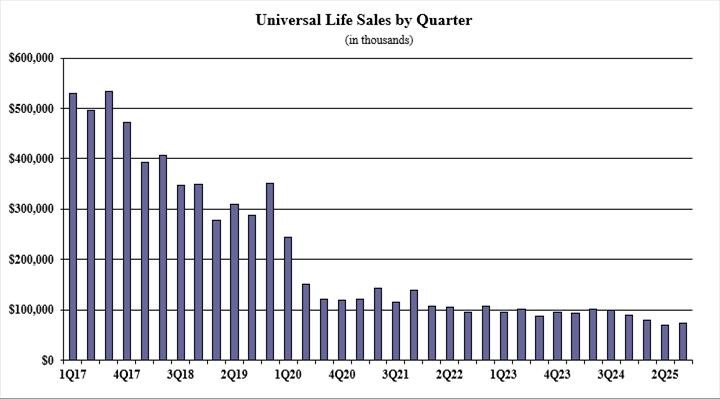

All universal life sales for the third quarter were over $1.1 billion, down 2.6% compared to the previous quarter and up 2.2% compared to the same period last year. All universal life sales include fixed UL, indexed UL, and variable UL product sales.

Noteworthy highlights for all universal life sales in the third quarter included Prudential ranking as No. 1 in overall sales for all universal life sales, with a market share of 10.8%. Transamerica Life’s Financial Foundation IUL II, an indexed universal life product, was the No. 1 selling product for all universal life sales, for all channels combined, for the second consecutive quarter.

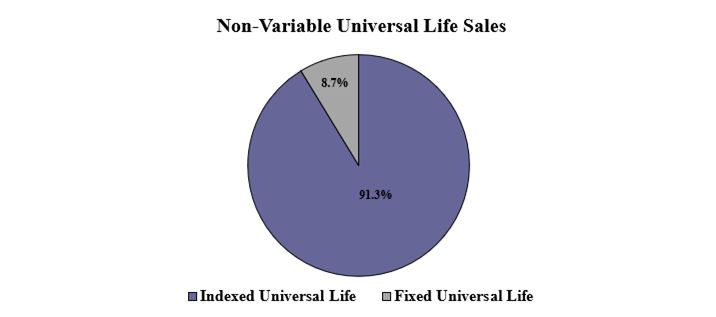

Non-variable universal life sales for the third quarter were $838.4 million, down 6.5% compared to the previous quarter and down 1.1% compared to the same period last year. Non-variable universal life sales include both fixed UL and indexed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the third quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 13.6%. Transamerica Life’s Financial Foundation IUL II, an indexed universal life product, was the No. 1 selling product for non-variable universal life sales, for all channels combined, for the second consecutive quarter.

Fixed Universal Life sales for the third quarter were $73 million, up 4.5% compared to the previous quarter and down 26.9% compared to the same period last year.

Items of interest in the fixed UL market included Nationwide retaining its No. 1 ranking in fixed universal life sales, with a 20.9% market share; Pacific Life Companies, John Hancock, Thrivent Financial, and Protective Life Companies completed the top five, respectively.

Nationwide’s Nationwide CareMatters II was the No. 1 selling fixed universal life insurance product, for all channels combined, for the fourth consecutive quarter. The top primary pricing objective of death benefit captured 34.5% of sales. The average fixed UL target premium for the quarter was $7,342, a decline of more than 5% from the prior quarter.

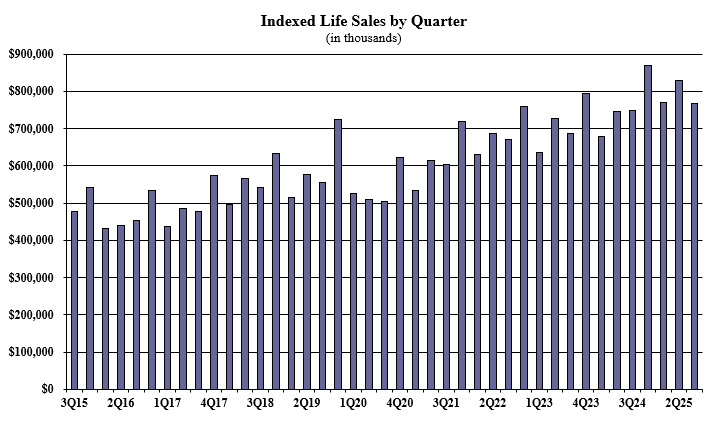

Indexed life sales for the third quarter were $768 million, down 7.4% compared with the previous quarter, and up 2.5% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

Key items of interest in the indexed life market included National Life Group maintaining its No. 1 ranking in indexed life sales, with a 14.8% market share; Transamerica, Pacific Life Companies, John Hancock, and Nationwide rounded out the top five, respectively.

Transamerica Life’s Financial Foundation IUL II was the No. 1 selling indexed life insurance product, for all channels combined, for the third consecutive quarter. The primary pricing objective for sales in the quarter was cash accumulation, which captured 73% of sales. The average indexed life target premium for the quarter was $12,447, a decline of nearly 4% from the prior quarter.

Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. said: “Indexed life sales will set a record in 2025. It will be interesting to see if that trend continues, given recent litigation with the product line.”

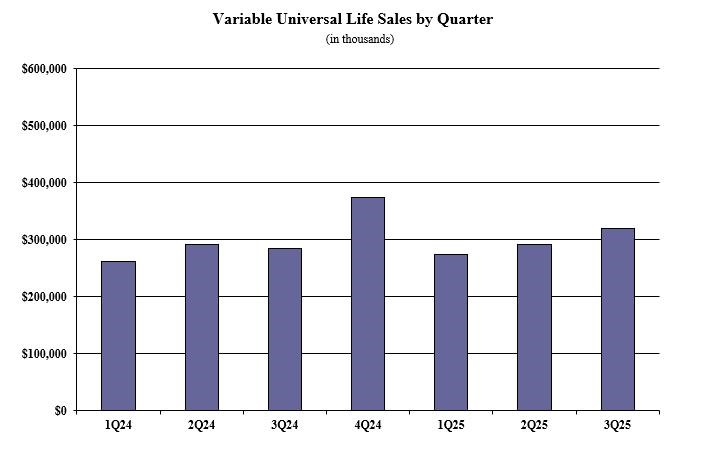

Variable Universal Life sales for the third quarter were $319.3 million, up 9.2% compared with the previous quarter and up 12.1% compared to the same period last year.

Items of interest in the variable universal life market included Prudential retaining the No. 1 ranking in variable universal life sales, with a 32.6% market share. Pacific Life Companies, Nationwide, John Hancock, and RiverSource Life completed the top five, respectively.

Pruco Life’s PruLife Custom Premier II was the No. 1 selling variable universal life product, for all channels combined for the quarter. The top primary pricing objective for sales this quarter was cash accumulation, capturing 65.7% of sales. The average variable universal life target premium for the quarter was $22,524, a decline of nearly 19.0% from the prior quarter.

“The market has been steadily increasing this year, and so has variable UL,” Moore said. “I anticipate that VUL sales will be up for the year.”

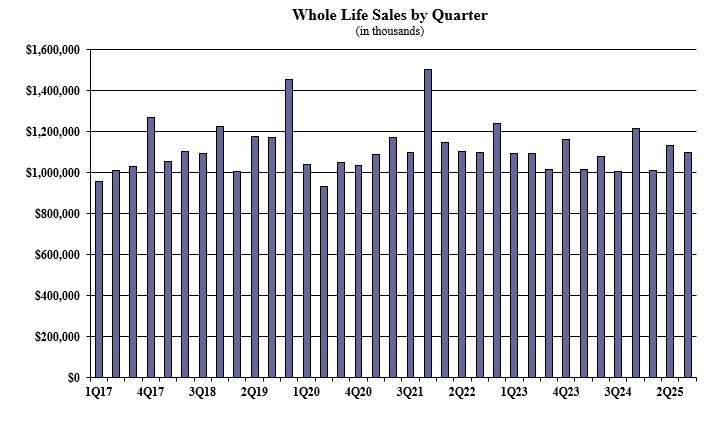

Whole life third quarter sales were over $1 billion, down 3.2% compared with the previous quarter, and up 8.8% compared to the same period last year.

Items of interest in the whole life market included the top primary pricing objective of final expense, capturing 73.3% of sales. The average premium per whole life policy for the quarter was $3,987, a decline of nearly 22% from the prior quarter.

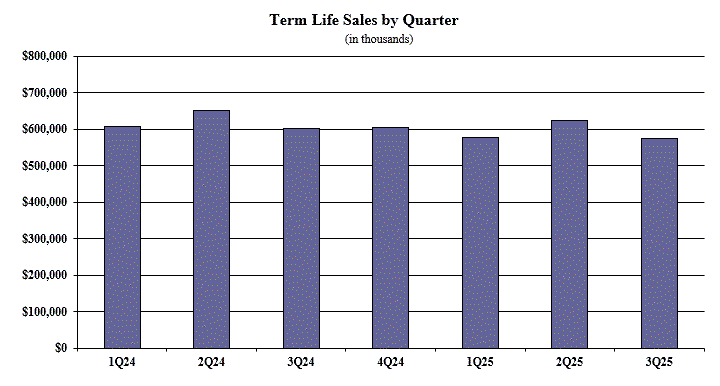

Term life third-quarter sales were $574.4 million, down 7.7% when compared with the previous quarter and down 4.6% compared to the same period last year.

Items of interest in the term life market included Prudential ranking as No. 1 in term life sales, with a 6.2% market share. Pacific Life Companies, Corebridge Financial, Protective Life Companies, and Massachusetts Mutual Life Companies completed the top five, respectively.

Pruco Life’s Term Essential 10 was the No. 1 selling term life insurance product, for all channels combined, for the second consecutive quarter. The average annual term life premium per policy reported for the quarter was $2,230, a decline of nearly 11% from the previous quarter.

Wink now reports sales on all annuity lines of business, Moore said, as well as all life insurance product lines.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post Prudential leads all life sellers as Q3 sales rise 3.2%, Wink reports appeared first on Insurance News | InsuranceNewsNet.