Agents risk losing clients as direct life channels score higher in satisfaction

Customer satisfaction with individual life insurance may look steady on the surface, but a closer look at J.D. Power’s 2025 U.S. Individual Life Insurance Study reveals growing divides — not only between carriers, but also between how clients view direct-to-consumer experiences and advisor-led relationships.

For agents and advisors, the findings are both a warning and an opportunity: policyholders clearly want more engagement, better communication, and a sense of ongoing value from the professionals they trust.

The real story is in the spread

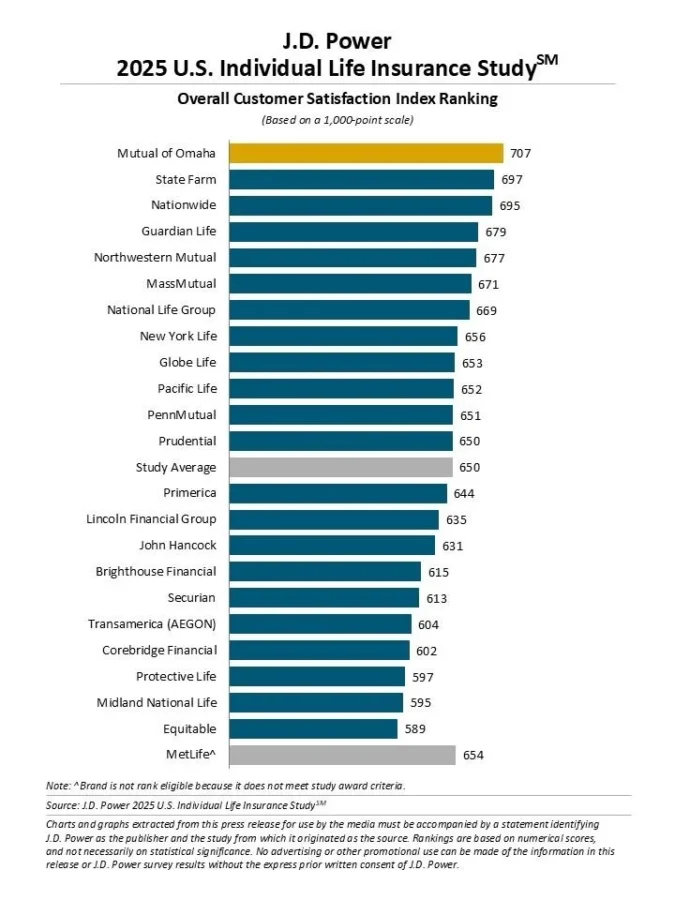

J.D. Power’s latest study ranks Mutual of Omaha highest in overall satisfaction with a score of 707 (on a 1,000-point scale), followed by State Farm at 697 and Nationwide at 695.

But while the leaders have pulled ahead, the bigger trend is volatility. More than 70% of carriers saw double-digit swings in satisfaction scores from the previous year — signaling an increasingly competitive market for trust and loyalty.

The study measures eight critical dimensions of customer experience: trust, value for price, ease of doing business, people, product offerings, ability to get service, problem resolution, and digital channels.

Direct channels gain ground on advisors

For the first time, J.D. Power’s data shows a striking gap between customers who buy policies directly from insurers and those who purchase through agents or advisors.

Customers who buy directly — whether online, via a call center, or through a mobile app — report satisfaction scores 57 points higher on average than those working with intermediaries (696 vs. 639).

The reason? According to J.D. Power, digital-first clients value convenience, transparency, and quick access to service — areas where many traditional distribution models still lag.

“Consumers increasingly expect insurance to work like their other digital services — fast, easy, and personalized,” said Craig Martin, executive director of global insurance intelligence at J.D. Power. “The challenge for agents is to combine personal connection with the efficiency of digital engagement.”

Many agent relationships have gone cold

Perhaps the most revealing finding for the advisory community: 58% of agent or advisor relationships are considered disengaged or transactional. In addition:

- 43% of clients said they have had no contact with their agent in more than three years.

- 15% described the relationship as purely transactional, limited to the sale itself.

Only 19% of clients reported what J.D. Power defines as a “trusted relationship,” one built on consistent communication and proactive service.

That trust translates directly to higher satisfaction: policyholders with trusted relationships reported an average score of 795, compared to just 542 among those whose agents rarely follow up.

These gaps underscore how critical ongoing contact is for retention — and how neglecting post-sale engagement leaves room for competitors or direct channels to step in.

Communication impacts satisfaction, loyalty

The study found that overall satisfaction is 50 points higher among customers who received any contact from their insurer or agent in the past year. But the type of contact matters.

Generic emails or policy reminders don’t move the needle. Personalized communication — such as policy reviews, beneficiary check-ins, or financial milestone discussions — have a far stronger impact on trust and loyalty.

For advisors, that means it’s not enough to stay visible — the interaction has to add value. Clients increasingly expect advice, education, and proactive guidance, not just a transaction or renewal notice.

Takeaways for life insurance professionals

As Martin said, insurers and agents alike “have opportunities to enhance the customer experience in ways that build greater trust and engagement.”

- Regular contact builds loyalty. Schedule annual or semiannual reviews — even brief check-ins help maintain connection.

- Blend personal touch with digital tools. Clients expect convenience; leveraging portals, e-signature tools, and automated reminders can enhance efficiency without losing the human element.

- Show the value of advice. Many policyholders who choose direct channels are motivated by simplicity and cost. Advisors can compete by demonstrating expertise in product selection, tax advantages, and long-term planning.

- Don’t assume satisfaction equals loyalty. With more carriers and platforms competing for attention, the agent’s ongoing role as a trusted educator has never been more important.

The 2025 U.S. Individual Life Insurance Study is based on responses from 5,065 life insurance customers collected between August 2024 and July 2025.

The post Agents risk losing clients as direct life channels score higher in satisfaction appeared first on Insurance News | InsuranceNewsNet.