Private assets, alternatives gain ground in the L/A sector

Life and annuity insurers continue to pursue an expanded universe of investment options to generate additional portfolio income. Conning’s analysis suggests life and annuity insurers will continue to broaden portfolio strategies into alternative and private assets while maintaining exposure to their traditional fixed-income sources.

The life and annuity industry has grown steadily during the past decade (see Figure 1) and Conning expects that trend to continue. Demand for life products continues to rise, supported by higher crediting rates enabled by elevated interest rates. Insurers of all sizes – not just larger firms – are developing more sophisticated, diversified portfolios featuring more alternative, private and less-liquid assets to help ensure they are better prepared to meet growing product demand.

Rising interest rates supporting market growth

The 2020 pandemic led to supply-chain challenges and increased fiscal support, resulting in higher inflation and necessitating a strong response from the Federal Reserve. Inflation has since proven stubborn, causing interest rates to remain elevated. Conning believes secular shifts – such as aging populations, rising fiscal deficits driving greater levels of government bond issuance and deglobalization – may continue to keep interest rates high and potentially raise them further.

Higher interest rates have positively impacted life carriers. The North American insurance industry experienced significant expansion in the past decade, achieving annualized premium growth of 6.5% since 2015.

Tail winds – such as higher interest rates, “peak 65,” significant industry capital formation, increased reinsurance capacity and product innovation – should continue to spur industry growth. Conning expects these trends to help grow the industry’s assets, which have risen by 4.7% annualized since 2015 to $5.6 trillion at the end of 2024.

Higher market yields

One key factor driving increased interest in products has been the improved crediting rates provided by life carriers. As illustrated in Figure 2, broader market interest rates were higher between 2015 and 2017 (corporate bonds are our proxy) which supported insurers’ crediting rates. However, as new cash rates fell in the later 2010s, book yields for the industry experienced significant pressure. While not the sole factor, investment income pressures drove many insurers to seek greater yield by broadening their investment options.

Life insurers seek broader asset allocation

No single data point can fully represent the evolving risk appetite of life insurers. However, Figure 3 provides an overview of the industry’s position at three-year intervals over the past decade. Notably, insurers have:

- Reduced their exposure to the highest rated bonds (AAA-A).

- Continued to expand their mortgage loan allocations.

- Increased allocations to Schedule BA assets.

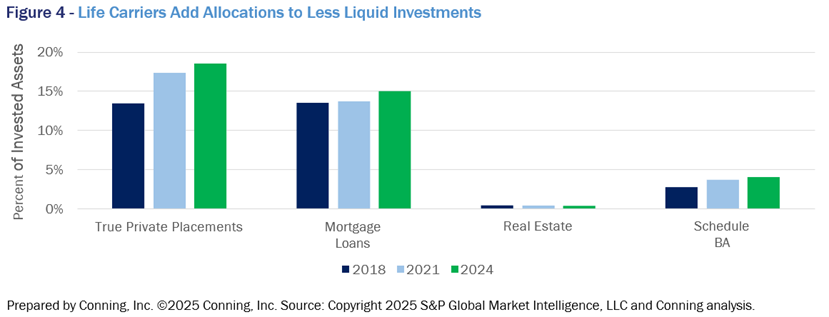

Upon closer examination, we see that the proportion of less liquid assets has grown significantly since 2018. The investment categories listed in Figure 4 have expanded to 38% of the portfolio from 30%. Private placements have experienced the most meaningful growth, to 19% from 13%. Perhaps not surprisingly, the areas of largest growth – mortgage loans and true private placements – typically offer greater yields than securities with similar ratings or similar capital charges.

Alternatives are not just for the largest insurers

While larger insurers have utilized these sectors and asset classes for many years, there is now broader adoption among insurers of all sizes. As Figure 5 shows, the largest companies continue to maintain considerable allocations in these less liquid investment categories. However, many smaller firms have also made notable changes in their allocations in the past five years. The smaller firms’ overall allocation to private placement investments rose to 8% from 2%, and their allocations to both mortgage loans and schedule BA assets grew by an average of 3%. Overall, the total allocations to these investments rose to 20% of their investable assets from 9%.

Greater interest in asset-backed securities

We also note that the industry’s allocations to parts of the asset-backed securities markets, notably esoteric ABS and CLOs, have been growing significantly; allocations to these types of securities grew to 13% of bonds in 2024 from 8% in 2015.

Life carriers have long been significant investors in the private markets. The private markets have grown significantly, with private credit being of particular interest for many life insurers. Some of these allocations are on an insurer’s balance sheets in the form of an LP commitment on schedule BA and a growing number hold a significant portion of the private credit exposure on the balance sheet as an investment-grade security (or securities) with a residual tranche. This would suggest some of the prior numbers pertaining to private assets, might be modestly understated.

Conning expects the life insurance industry to continue to experience significant asset growth and that carriers will look to expand their investment opportunity set. Companies will watch for investments with attractive yield and particularly longer duration options.

We expect growth to continue in private credit, commercial mortgage loans, private placements, CLOs and esoteric asset-backed securities. Additionally, there has been growing interest in other sectors and investments that are less commonly considered. One sector of significant potential growth is infrastructure, where opportunities exist in both debt and equity for insurers to gain exposure to real assets and cash flows. Compared to global insurers, U.S. insurers are under allocated to this sector.

While there are many reasons to be optimistic, several areas warrant caution, including:

- Heightened market volatility and uncertainty affecting various investments in an insurer’s portfolio.

- Managing increasing exposures to less liquid investments within a comprehensive ALM framework.

- A growing portion of assets supporting liabilities which could exhibit significant optionality.

- Discussions on potential changes to regulations and capital charges for investments.

Life insurers build for the longer term

Conning believes that greater diversification of insurers’ portfolio strategies is a healthy trend. While the era of low interest rates was a challenge, insurers learned more about the alternative, private and less liquid investment opportunities available. They appear to be putting that knowledge to good use and structuring portfolios that may better serve them in the long term as demand for their products continues to grow.

Interest rates will likely remain elevated for an extended period, which can be a plus for life carriers. However, market tests often appear with little warning and can offer unforeseen investment and ALM challenges. A well-diversified portfolio designed to serve the long-term needs of an insurer’s book of business can be an excellent defense mechanism.

Cindy Beaulieu is a managing director, portfolio manager and chief investment officer of Conning North America, responsible for insurance and institutional pension assets. Contact her at cindy.beaulieu@innfeedback.com.

Matthew Reilly, CFA, is a managing director and head of insurance solutions at Conning North America, responsible for the creation of investment strategies and enterprise solutions for insurance companies. Contact him at matthew.reilly@innfeedback.com.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post Private assets, alternatives gain ground in the L/A sector appeared first on Insurance News | InsuranceNewsNet.